OpenSea leads as the best NFT marketplace. It controls over 90% of NFT trading volume with its user-friendly interface and support for multiple blockchains.

Along with it, there are many other popular platforms, such as Magic Eden, Rarible, and SuperRare, that serve millions of users worldwide. The NFT art segment recorded $23.8 million in just 30-day sales.

These marketplaces benefit artists selling digital creations, collectors seeking unique pieces, and investors exploring new opportunities. Further in the article, you will find the top NFT marketplaces, current trends, challenges facing the industry, and future predictions for 2026.

Current State Of The NFT Art Market

The NFT market overall shows strong growth potential, with the global NFT market valued at $26.9 billion in 2023 and expected to hit $211.7 billion by 2030.

However, the NFT art segment recorded $23.8 million in 30-day sales by February 2025, indicating a focused niche within the broader market.

While overall NFT sales reached $2.82 billion in early 2025, the art segment faced challenges with reduced trading volumes compared to the 2021 peak.

The market has changed from quick-profit speculation to long-term utility. Buyers are now focusing on real value instead of hype. These numbers show NFT is still a thing in 2026.

Top 8 NFT Art Marketplaces In 2026

The top NFT art marketplaces are OpenSea and Magic Eden. Besides them, there are numerous popular NFT art marketplaces used by many artists, collectors, and traders worldwide.

Each marketplace offers unique features and blockchain support to match different goals and budgets.

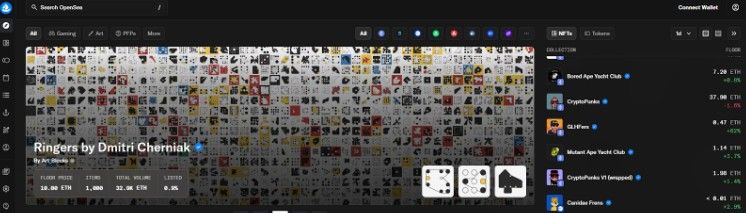

1. OpenSea

OpenSea is the largest NFT marketplace, dominating with 90% of all NFT trading volume. The platform supports multiple blockchains, including Ethereum, Polygon, and Klaytn, making it accessible for various users.

OpenSea’s monthly trading volume exceeded $2.6 billion in recent months, though token trading accounted for most of it. The platform hosts over 20 million NFTs across categories like art, music, and collectibles.

Its easy-to-use interface and free minting tools make it ideal for newcomers. OpenSea charges a 2.5% fee on sales with no listing charges.

Best For: Beginners and diverse collections

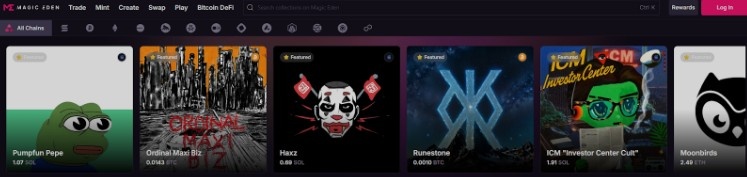

2. Magic Eden

Magic Eden started on Solana but evolved into a multi-chain platform supporting Ethereum, Bitcoin, and Polygon. The marketplace charges only 2% transaction fees with no listing costs, making it affordable for creators.

It specializes in gaming NFTs and Bitcoin Ordinals, attracting niche communities. The platform offers a Launchpad feature for new projects and includes a gamified rewards system with Diamonds and staking options.

Magic Eden’s user-friendly design and low fees have made it popular among crypto enthusiasts exploring NFT-based gaming and rewards.

Best For: Gaming NFTs and collectors

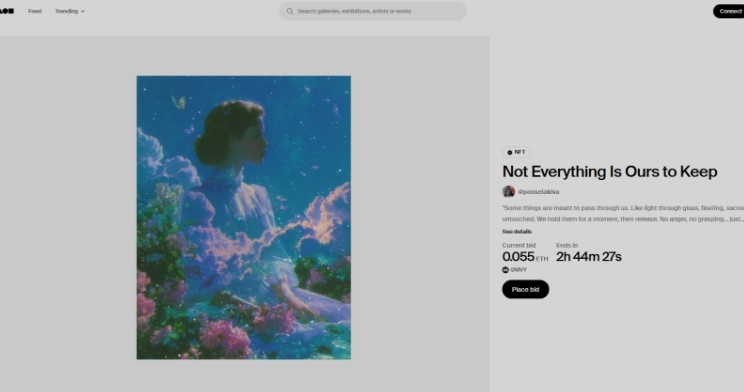

3. Foundation

Foundation operates as an invite-only marketplace on the Ethereum network. It focuses exclusively on high-quality digital art.

Artists need to apply or receive invitations to join, ensuring the highest quality artwork. The platform offers creators eight different selling methods, providing flexibility in how they monetize their work.

Foundation’s selective approach creates a premium environment where collectors find unique, carefully vetted pieces. The marketplace has built a strong community of established and emerging artists.

Best For: Premium digital art creators

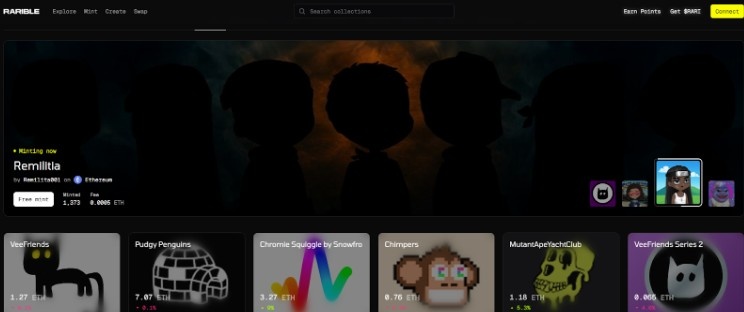

4. Rarible

Rarible functions as a community-owned marketplace where users hold RARI tokens, giving them governance rights. The platform distributes approximately 75,000 RARI tokens weekly to active buyers and sellers.

It supports multiple blockchains, including Ethereum, Polygon, Solana, and Flow. Rarible’s fee structure ranges between 0.5% and 7.5%, depending on the transaction. The multi-buy feature lets users purchase multiple NFTs in a single transaction, saving on gas fees.

Artists can set royalties up to 50% and earn from secondary sales. The platform focuses on getting the community involved in all the decision-making processes.

Best For: Community-driven projects and artists

5. SuperRare

SuperRare focuses on single-edition digital artworks, creating scarcity and exclusivity. The marketplace hosts over 32,000 art-based NFTs, all verified for quality.

It operates on the Ethereum network, requiring ETH for all transactions and bids. Artists cannot mint tokens freely; they must apply and wait for approval from the moderation team.

This selective process maintains high standards and potentially high market values. SuperRare attracts serious collectors who are willing to invest in unique, rare pieces. The platform has become known for hosting work from leading concept artists.

Best For: High-end art collectors only

6. Binance NFT

Binance NFT integrates directly with Binance accounts. It offers seamless trading for existing users. The platform charges around 1% platform fees on sales, which is among the lowest in the industry.

It supports NFTs on both the Binance Smart Chain and the Ethereum network. Unique features include NFT loans, which allow users to borrow against their NFTs as collateral.

The marketplace covers categories like art, sports, entertainment, and gaming. However, it remains unavailable to users in the United States.

Best For: Existing Binance exchange users

7. Mintable

Mintable allows gasless minting, allowing creators to list NFTs without paying upfront blockchain fees. It was founded in 2018, and the platform supports Ethereum and Immutable X blockchains for faster, cheaper transactions.

Artists can set royalties up to 90% on future resales, maximizing long-term earnings. The platform offers batch minting, which allows the creation of up to 2,000 NFTs in a single transaction.

Mintable checks each token for uniqueness to protect intellectual property. The marketplace makes NFT creation accessible for newcomers without technical knowledge or initial investment.

Best For: New creators

8. Nifty Gateway

Nifty Gateway focuses on exclusive drops from top artists and major brands. Founded in 2018, it operates on the Ethereum blockchain with purchases made in ETH.

The platform charges a fee of up to 5% and prioritizes quality over quantity. Nifty Gateway carefully presents its offerings, featuring the famous artists from the crypto space.

Famous works, including pieces by Beeple, have sold through this marketplace. Users can create accounts and purchase NFTs during scheduled drop events. The platform targets collectors seeking rare, high-value pieces from established names.

Best For: Exclusive artist drops only

Which Is the Best Free NFT Marketplace?

OpenSea is the best free marketplace because it charges no listing fees and allows free NFT creation using its minting tools. However, it charges a transaction fee on sales.

Mintable also offers gasless minting, letting creators list without upfront costs. On the other hand, Magic Eden provides free listings with only 2% fees on actual sales.

To be straightforward, there is no marketplace that is completely free because blockchain transactions always have gas fees. Many platforms offer ‘lazy minting’; this approach shifts those expenses onto buyers.

Creators can mint and list their NFTs without any upfront costs, while the buyer covers the gas fee when the purchase actually happens.

How To Choose The Right NFT Art Marketplace?

Selecting the right NFT art marketplace depends on your goals, whether you’re an artist, collector, or investor.

Consider the following factors that might help you:

- Transaction Fees: Compare platform fees ranging from 1% to 10%. Lower fees mean more profit from your sales or purchases.

- Blockchain Support: List the blockchains the platform supports. Ethereum offers the largest market, while Solana and Polygon provide lower gas fees.

- Gas Fees: Look for platforms offering gasless minting or lazy minting options to reduce upfront costs for creators.

- Royalty Systems: Artists should choose platforms that allow secondary sale royalties, with some offering up to 50% or 90% on resales.

- Community Size: Larger communities mean more visibility and potential buyers. Active users increase your chances of selling NFTs quickly.

- User Interface: Pick platforms with simple, easy-to-navigate designs, especially if you’re new to NFTs and blockchain technology.

- Wallet Compatibility: Ensure the marketplace supports your crypto wallet, like MetaMask, Phantom, or Coinbase Wallet, for smooth transactions.

- Verification Systems: Choose platforms with strong authentication features to avoid counterfeit NFTs and protect your investments.

- Payment Options: Some marketplaces accept credit cards alongside cryptocurrency, making it easier for non-crypto users to participate.

- Liquidity Options: Look for platforms that offer auctions, fixed prices, and fractional ownership to maximize your buying or selling flexibility.

Challenges Facing NFT Art Marketplaces

Despite growing adoption, NFT art marketplaces face several obstacles that affect artists, collectors, and investors. Go through these challenges to better navigate the market.

1. Market Volatility and Speculation

The NFT market experiences extreme price swings, with values dropping from the 2021 peak. Many buyers enter seeking quick profits rather than appreciating art, leading to volatile pricing. When speculation cools, demand falls sharply, leaving creators and collectors with devalued assets.

2. Copyright and Intellectual Property Issues

‘Copyminters’ steal artworks from artists’ websites and mint them as NFTs without permission, claiming false ownership. Regulatory bodies struggle to enforce copyright protection due to the decentralized nature of blockchain technology. Artists often discover their work is being used illegally with no easy recourse.

3. Environmental Concerns

Before the Ethereum Merge upgrade, each NFT produced over 200kg of CO2, equaling one person’s monthly energy consumption. While newer proof-of-stake blockchains reduced this impact by 99.95%, environmental concerns still affect public perception and artist participation in NFT markets.

4. High Gas Fees

Ethereum gas fees create barriers for artists and buyers, sometimes costing $50 to $200 per transaction. These high costs prevent small creators from minting NFTs and discourage buyers from making purchases. Alternative blockchains offer lower fees but have smaller user bases.

5. Regulatory Uncertainty

Different countries treat NFTs inconsistently, with some classifying them as securities while others provide no official rules. Clear frameworks are still developing worldwide. But currently, this leaves users uncertain about future regulations.

6. User Experience Complexity

Setting up crypto wallets and managing private keys can complicate onboarding. New users find the technical requirements overwhelming, limiting mainstream adoption. Many potential traders abandon NFT marketplaces due to these barriers before completing their first transaction.

7. Fraud and Scam Risks

Counterfeit NFTs flood marketplaces, with scammers creating fake versions of popular collections. Unauthorized use of copyrighted material appears frequently, deceiving buyers. Phishing attacks target users’ wallets, and fake marketplaces trick people into connecting their accounts, resulting in stolen funds.

8. Valuation Uncertainty

NFT prices remain difficult to predict because values depend on factors such as scarcity, uniqueness, and buyer perception. New sellers struggle to forecast demand and set appropriate prices.

Future of NFT Art Marketplaces

The NFT art marketplace is evolving beyond simple trading platforms into a complete creator world. Smart contracts and blockchain technology are reshaping how artists earn, with new opportunities emerging across multiple industries.

- Artists will earn royalties automatically through on-chain smart contracts.

- As per Binance, Gaming and virtual real estate will dominate NFT adoption by 2030 with massive growth.

- Interoperable NFTs will allow seamless asset movement between different platforms globally.

- AI-generated art will account for increasing percentages of new NFT projects.

- Music NFTs will become mainstream tools for artists to monetize directly.

- Decentralized marketplaces will remove middlemen, giving creators full control over earnings.

- Multi-format support will expand to include AR, VR, and 3D interactive experiences.

- All these factors will drive the NFT market valuation to surpass $211.7 billion by 2030.

Also Read:

Conclusion: OpenSea Is The Most Used NFT Art Marketplace

OpenSea is the most popular NFT art marketplace worldwide. But there are other marketplaces too, such as Magic Eden, Foundation, Binance NFT, and many more, with multiple NFT art collections.

For creators looking to monetize their work or buyers wanting unique digital pieces, these marketplaces offer genuine opportunities.

Start exploring different platforms, understand their features, and find the one that matches your specific needs and creative vision.

FAQs

Art NFTs remain active with $23.8 million in monthly sales. The market has shifted from speculation to utility-focused applications, which attract serious collectors and long-term investors.

NFTs can be sold on cryptocurrency marketplaces, which you can then convert to fiat currency through exchanges. The process requires a crypto wallet and account on a trading platform.

As of now, OpenSea is best for beginners because it offers a user-friendly interface, free minting tools, no listing fees, and support for multiple blockchains, with the largest collection of NFTs.

Rarible offers community governance and higher royalty options up to 50%, while OpenSea provides a larger user base and higher liquidity. The choice depends on your priorities as creator or collector.

The NFT art segment recorded $23.8 million in 30-day sales during February 2025. The broader NFT market generated $2.82 billion in the first half of 2025 across all categories.

OpenSea works best for diverse audiences. On the other hand, SuperRare is best suited for premium collectors, and Rarible is worthwhile for community-driven projects. However, your choice should match your art style, target buyers, and preferred blockchain network.