Both NFTs (Non-Fungible Tokens) and Cryptocurrencies are digital assets. Both live on blockchains. Both confuse people who don’t spend their free time reading Reddit threads about decentralization.

Crypto keeps showing up in news headlines whenever Bitcoin decides to have a day. NFTs had their weird moment when someone paid actual millions for a picture of a bored ape.

To keep it short, crypto is digital money, and NFTs are digital ownership receipts. I’ll break down what each one does, then put them side by side so you can figure out if either deserves your attention or your money.

Keep reading, and you might actually understand what people are talking about when they use words like blockchains and forks.

What Is Cryptocurrency?

Cryptocurrency is money made of code instead of paper. No coins you can hold, no bills in a wallet, it is just numbers moving between digital addresses. It runs on blockchains, which are public ledgers that thousands of computers maintain at once.

Bitcoin started the whole thing back in 2008, supposedly created by someone calling themselves Satoshi Nakamoto. Nobody knows who that actually is. The original idea was simple, which was to make money that governments can’t control and banks can’t freeze.

Different cryptos do different things now. Bitcoin mostly sits there being valuable and hard to move quickly. Ethereum lets people build apps that run on its network without needing a company behind them.

Solana tries to do what Ethereum does, but faster. Stablecoins just copy the dollar, so your money doesn’t lose half its value on a Tuesday. In October 2025, the whole crypto market was worth over $3.7 trillion.

That sounds wild until you remember it’s still smaller than what Apple was worth at one point.

What Is an NFT (Non-Fungible Token)?

The name is bad. Nobody says “non-fungible token” out loud unless they’re trying to explain it to someone. Fungible means replaceable, where your dollar works the same as my dollar.

Non-fungible means unique, which means your dog is not the same as my dog, even if they’re the same breed.

An NFT proves you own something specific on the internet. Could be art, could be a ticket, could be a sword in a video game.

The proof lives on a blockchain through smart contracts. When people started dropping six figures on cartoon monkey pictures in 2021, that’s when NFTs became a thing everyone had an opinion about.

But as explained in this NFT guide, the actual art usually sits on some server. What you own is the token that points to it and says it’s yours. Whether that’s meaningful or stupid depends on who you ask.

Similarities Between NFTs & Cryptocurrencies

Even though most people know that NFTs and Cryptocurrencies are different, they fail to understand how they “work” differently, and that is because they share enough DNA that people mix them up constantly.

1. Technology Backbone

Both NFTs and Cryptocurrencies use blockchains, which are those databases that live on thousands of computers at once, all keeping the same records.

When you make a move, all those computers check it before anything gets written down. Makes it really hard to cheat the system without hacking thousands of machines simultaneously.

2. Decentralization & Trustlessness

For both NFTs and Cryptocurrencies, there is no bank in the middle. No company is taking fees and making rules. The network handles everything through code and math. Moving Bitcoin or buying an NFT, the basic mechanics work the same way.

3. Tokenization & Provenance

Everything becomes a token on the chain. You can trace any token back to the beginning and see everyone who owned it before. That permanent history is what makes the whole thing function.

4. Scarcity & Supply Control

Both create value by limiting supply. Bitcoin caps at 21 million coins ever. Most NFT projects set a maximum number of pieces. Built-in scarcity, whether that’s good design or manufactured hype.

Key Differences Between NFTs & Cryptocurrencies

Here’s where they stop being siblings and become different species. One Bitcoin equals another Bitcoin, period. But NFT #347 is not NFT #348, even if they’re from the same collection and look nearly identical.

You can spend 0.5 Bitcoin. You can’t spend 0.5 of an NFT. Crypto functions as money or a bet on technology. NFTs function as proof that you own something.

Crypto value follows markets and adoption. NFT value follows whether anyone else wants the exact thing you bought.

1. Fungibility vs Uniqueness

A cryptocurrency is identical to itself everywhere. One Ethereum equals one Ethereum equals one Ethereum. NFTs are individual snowflakes. Even two NFTs from the same drop have different IDs and different histories. This matters for everything else about how they work.

2. Divisibility & Units

You can buy fifty bucks’ worth of Bitcoin and get a fraction of a coin. Crypto divides down to absurd decimal places. NFTs stay whole. You own it completely, or you don’t own it. Some people have tried splitting NFTs into fractions, but it’s messy and rare.

3. Purpose & Utility

Cryptocurrencies were built to be money or to run networks. Bitcoin wanted to replace the dollar. Ethereum wanted to become a computer that anyone could use.

NFTs do something else entirely, where they prove ownership in places where ownership used to be meaningless. Different job, different tool.

4. Liquidity & Market Structure

You can sell Bitcoin in three seconds on a hundred different exchanges. Millions of people trade it every single day.

NFTs move through marketplaces like OpenSea, and finding someone who wants your specific piece can take forever. Thin markets, slow sales, way more risk of being stuck holding something nobody wants.

5. Valuation & Risk

Crypto prices respond to adoption numbers, tech upgrades, legal news, and market sentiment.

NFT prices care about social proof, proof like who made it, is the collection famous, do celebrities own pieces, is the community dead or alive. An NFT from a dead project becomes worthless instantly, no matter what you paid.

6. Regulation & Legality

Governments started treating crypto like it’s somewhere between a security and a commodity. Actual rules exist now about trading and taxes.

The SEC has been suing crypto companies for years. NFTs are murkier. Nobody knows if they’re securities or collectibles, or something brand new. Copyright issues still get argued in court.

Crypto vs NFT Market Outlook & Future Trends

You can talk all you want about concepts and theories, but if the words do not convert, there is no point in something that claims to be the future of investment. Let’s look

1. Crypto Market Outlook

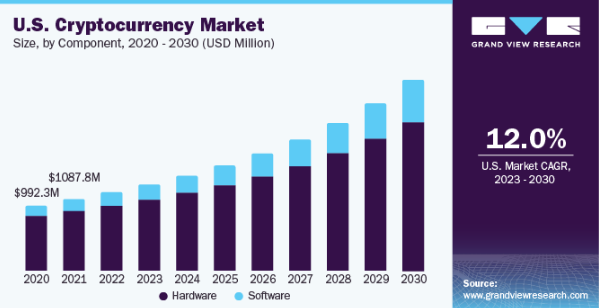

Total crypto market value shot past $4 trillion in July 2025 when Bitcoin was running hot. Real institutions are in now. Spot Bitcoin ETFs launched in the US so regular people can buy through normal brokerages.

Companies like MicroStrategy have billions in Bitcoin just sitting on their books. This stopped being a hobby a while ago.

The tech keeps evolving, too. Layer-2 solutions handle transactions off the main chain to make things faster and cheaper. People are working on tying crypto to real-world stuff like property deeds and stock shares.

AI integration is the current buzzword, though what that means exactly is anyone’s guess. Problems haven’t changed much, the prices swing hard, regulations keep shifting, and getting hacked is always possible. But crypto isn’t disappearing. Too much infrastructure already exists.

2. NFT Market Outlook

The NFT market was sitting at around $49 billion in 2025. Some analysts predict it’ll hit $200 billion by 2030. Those numbers are basically educated guesses at best. The market grew fast after the early days, when anything would sell at any price.

Now, NFTs need actual reasons to exist. Gaming companies put real items in games as NFTs. Ticketing companies use them to stop scalpers and verify authenticity. Brands make digital collectibles that unlock real perks.

The metaverse thing, if it actually happens, runs on NFT ownership for virtual property. Technology is getting better at making NFTs portable across different chains instead of being locked to one. Better research tools exist now for buyers.

The downside is that most NFTs from the 2021 rush are worthless today. The market is full of dead projects nobody remembers. Environmental concerns about energy use still come up, though newer chains use way less power than old ones.

Top Cryptocurrencies and Most Expensive NFTs Ever Sold

If you don’t understand much about either, you still might have heard about the most famous cryptos and NFTs. Here are some of them.

Top 5 Cryptocurrencies by Market Cap

- Bitcoin stays on top. Always has. Was trading above $110,000 in October 2025, market cap over $2.2 trillion. Every other crypto gets measured against Bitcoin’s performance.

- Ethereum sits at number two. Hosts most decentralized apps and NFT platforms. If Bitcoin is digital gold, Ethereum is the operating system everyone builds on.

- Binance Coin powers the Binance exchange and everything connected to it. Mostly useful if you’re trading on that platform or using apps built on Binance Smart Chain.

- Solana got famous for fast transactions and tiny fees. Developers like it because building costs less than on Ethereum.

- XRP was made specifically for banks to move money across borders fast. Been in a legal fight with the SEC forever, which messed with its price.

Top 5 Most Expensive NFTs Ever Sold

Want to see how wild NFT prices can get? According to this list of most expensive NFTs, here are five that broke records and defined digital art history:

- The Merge by Pak went for $91.8 million in December 2021. It wasn’t actually one piece, though. Almost 29,000 people bought units that merged into a collective work. Whether that counts as one sale or thousands is still up for debate.

- Beeple’s “Everydays The First 5000 Days” sold for $69.3 million at Christie’s in March 2021. This was the moment traditional art institutions decided NFTs might be real. The piece was a collage of images Beeple made every day for 14 years.

- Clock, made by Pak and Julian Assange, sold for $52.7 million. Money went to Assange’s legal fund. The art was just a timer showing how long he’d been in prison.

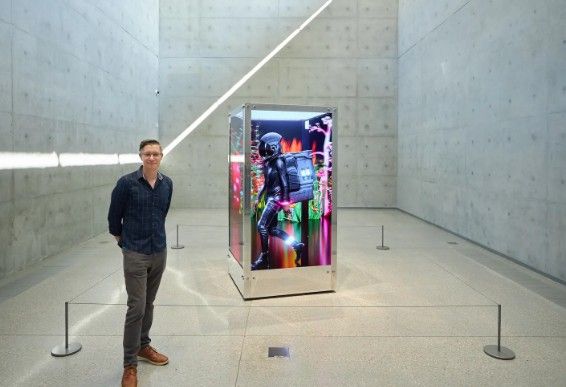

- HUMAN ONE by Beeple went for $28.9 million. Combined a physical sculpture with screens showing digital art that Beeple can update remotely. Either brilliant or defeats the whole point, depending on your view.

- CryptoPunk #5822 sold for $23.7 million. One of nine alien punks in the original 10,000-piece set. CryptoPunks started the whole NFT collectibles wave.

Crypto or NFTs: What Should You Buy?

Depends on what you’re after. If you want something that acts like an investment with actual liquidity, then buying Crypto makes more sense.

You can buy and sell easily. Exchanges run 24/7. Millions of people trade daily, so there’s always a market. Prices bounce around like crazy, but at least you can exit when you need to.

Buy NFTs if you actually care about owning digital stuff or supporting artists directly. If gaming matters to you and you want to own your items across different games, NFTs might be worth it.

If the metaverse becomes real, NFTs are how ownership works there. But don’t buy NFTs expecting to flip them for profit unless you really know what you’re doing. The market is brutal. Most projects fail.

You can own both if you want to spread bets. Just remember, both are speculative, both swing wildly, and both could go to zero. Never put in money you need for rent or food.

Start small. Research everything first. Verify marketplaces are legitimate before connecting your wallet. Maybe talk to someone who actually understands this stuff before putting down serious money.

The main difference boils down to the fact that crypto works like money, and NFTs work like receipts.

FAQs

Usually no. You own the token itself but not the copyright to the underlying work. The creator keeps reproduction rights unless they explicitly transfer copyright in the sale agreement.

No, they serve completely different purposes. You typically need crypto to buy NFTs, but you can’t swap an NFT for crypto like exchanging currencies.

Projects die, hype vanishes, and people realize they overpaid during bubbles. Most NFTs from 2021 are worth almost nothing now because demand evaporated.

It adds complexity and trust problems. You co-own something with strangers through smart contracts, which can have bugs or disagreements about selling.