Bitcoin has a maximum supply of 21 million coins, and about 19.94 million are currently circulating. This means approximately 94.95% of the total supply has already been mined.

Only 1.06 million Bitcoins remain to be created. With a market cap of $2.269 trillion, it stands as the most valuable cryptocurrency worldwide.

However, this value has fallen recently, with Bitcoin trading around $113,885 after reaching an all-time high of $124,000 in August of 2025. This article covers Bitcoin’s supply, mining rate, ownership, lost coins, and what happens when the last Bitcoin gets mined.

Only 21 Million Bitcoin Can Ever Exist

The maximum supply of Bitcoin is 21 million. This high limit was built into Bitcoin from the start to prevent inflation, and the scarcity makes it as precious as gold.

Unlike traditional currencies that governments can print endlessly, Bitcoin’s supply cannot be increased. No central authority can change this limit. This makes Bitcoin’s supply transparent and predictable for all users.

Total Bitcoins Circulation In 2025

Currently, 19.94 million Bitcoins are in circulation. This represents 94.957% of the total Bitcoin supply. The circulating supply continues to grow as miners add new blocks to the blockchain approximately every 10 minutes.

The total market value of all circulating Bitcoins equals $2.27 trillion, making Bitcoin more valuable than most traditional companies and assets worldwide.

Who Owns The Most Bitcoin?

U.S. Spot Exchange-traded funds (ETFs) now hold the largest share with 1,104,534 Bitcoins, a number higher than many countries that use Bitcoin. It even surpassed Satoshi Nakamoto’s estimated holdings of 1.1 million BTC.

Binance and MicroStrategy follow the ETF and Satoshi Nakamoto’s bitcoin holdings. However, among individuals, Satoshi Nakamoto, the creator of Bitcoin, is believed to hold 1.1 million BTC, though these coins have never moved.

Source: CNBC

How Many Bitcoins Are Mined Every Day?

Miners create approximately 450 new Bitcoins daily after the April 2024 halving event. This happens because 144 blocks are mined each day.

Each block currently rewards miners with 3.125 BTC. The mining rate will continue to decrease with each halving event, which occurs every four years, until the last Bitcoin is mined around 2140.

Bitcoin Halving Historical Timeline

Bitcoin halving is an event that cuts mining rewards in half approximately every 4 years or after 210,000 blocks are mined. This controls Bitcoin’s supply and ensures its scarcity over time.

Halving Timeline:

- November 28, 2012 (Block 210,000): Block reward reduced from 50 BTC to 25 BTC

- July 9, 2016 (Block 420,000): Block reward reduced from 25 BTC to 12.5 BTC

- May 11, 2020 (Block 630,000): Block reward reduced from 12.5 BTC to 6.25 BTC

- April 20, 2024 (Block 840,000): Block reward reduced from 6.25 BTC to 3.125 BTC

- Next Halving: Expected in April 2028 (Block 1,050,000), when the reward will drop to 1.5625 BTC per block.

Each halving reduces the rate of new Bitcoin creation. This makes it more scarce and potentially more valuable. The halving events will continue until all 21 million Bitcoins are mined around the year 2140.

Bitcoin Market Price

- Current BTC Price: $113,885.92

- Current BTC Market Cap: $2.27 trillion

- 24-Hour Trading Volume: $58.92 billion

- All-Time High: $124,000 (August 2025)

- Fully-Diluted Value (FDV): $2.39 trillion

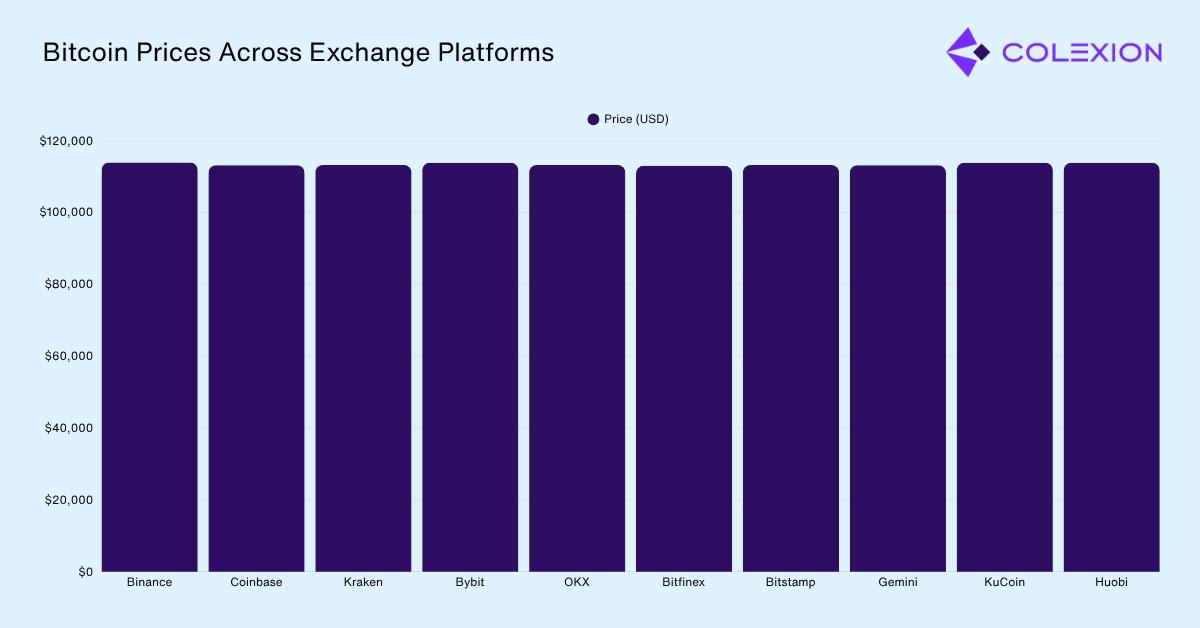

Bitcoin Price Across Major Exchange Platforms

Bitcoin prices vary slightly across exchanges due to liquidity, trading volume, and regional demand.

Here is a table of the Bitcoin prices on different exchange platforms.

| Exchange | Trading Pair | Price (USD) | 24h Volume |

|---|---|---|---|

| Binance | BTC/USDT | $113,892.00 | $12.8B |

| Coinbase | BTC/USD | $113,159.95 | $8.4B |

| Kraken | BTC/USD | $113,200.10 | $3.2B |

| Bybit | BTC/USDT | $113,885.50 | $4.6B |

| OKX | BTC/USDT | $113,227.50 | $5.1B |

| Bitfinex | BTC/USD | $113,050.00 | $1.2B |

| Bitstamp | BTC/USD | $113,234.00 | $892M |

| Gemini | BTC/USD | $113,156.54 | $654M |

| KuCoin | BTC/USDT | $113,880.20 | $2.3B |

| Huobi | BTC/USDT | $113,845.00 | $1.8B |

Source: CoinMarketCap

Note: The BTC price is as of 28 October 2025. Due to the volatile Crypto market, prices fluctuate daily.

Bitcoin Price History

Bitcoin’s price journey shows its evolution from a digital currency to a mainstream investment asset. Historical data reveals volatility alongside remarkable growth over the years.

| Date | Open | Close | Volume | Market Cap |

|---|---|---|---|---|

| Oct 27, 2025 | $114,479.85 | $114,119.32 | $61.76B | $2.27T |

| Dec 01, 2024 | $96,847.00 | $97,180.00 | $52.34B | $1.93T |

| Dec 01, 2023 | $37,689.00 | $42,265.00 | $28.45B | $828.7B |

| Dec 01, 2022 | $17,088.00 | $17,166.00 | $21.67B | $330.2B |

| Dec 01, 2021 | $57,226.00 | $56,477.00 | $35.89B | $1.07T |

| Dec 01, 2020 | $18,830.00 | $19,701.00 | $24.12B | $365.8B |

| Dec 01, 2019 | $7,454.00 | $7,196.00 | $18.34B | $130.5B |

| Dec 01, 2018 | $4,245.00 | $3,742.00 | $12.78B | $65.3B |

Source: CoinMarketCap Price

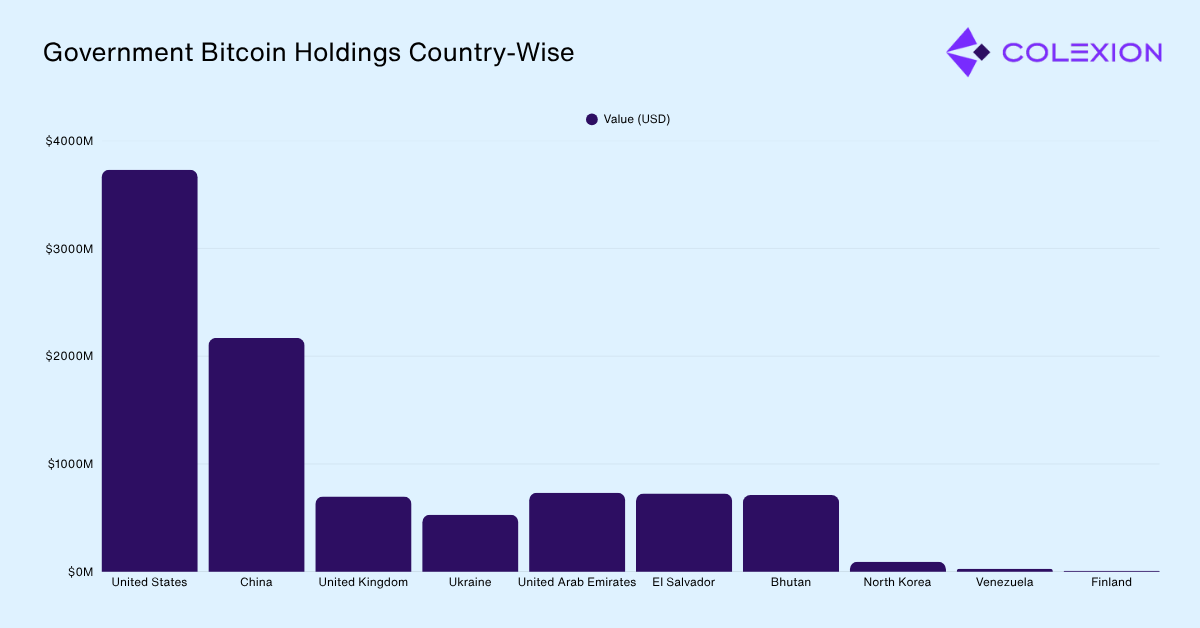

Government Bitcoin Holdings

Governments worldwide hold most Bitcoin reserves. They are mainly acquired through criminal asset seizures, donations, and state-sponsored mining operations.

These holdings represent approximately 3% of Bitcoin’s total supply.

| Rank | Country | Bitcoin Holdings | Value (USD) | Acquisition Method |

|---|---|---|---|---|

| 1 | United States | 326,588 BTC | $37.31B | Criminal seizures (Silk Road, Bitfinex hack) |

| 2 | China | 190,000 BTC | $21.70B | PlusToken scam seizure |

| 3 | United Kingdom | 61,245 BTC | $6.99B | Financial crime seizures |

| 4 | Ukraine | 46,351 BTC | $5.29B | War-time donations |

| 5 | United Arab Emirates | 6,420 BTC | $734M | Various seizures |

| 6 | El Salvador | 6,363 BTC | $727M | Official adoption purchases |

| 7 | Bhutan | 6,227 BTC | $712M | Hydroelectric-powered mining |

| 8 | North Korea | 803 BTC | $92M | Suspected cyber theft |

| 9 | Venezuela | 240 BTC | $27M | State mining operations |

| 10 | Finland | 90 BTC | $10M | Criminal confiscations |

Source: Bitcoin Treasuries

The total Government holds approximately 644,327 BTC, roughly valued at $73.45B current prices. Additionally, public and private companies have adopted Bitcoin as a treasury reserve asset.

Strategy (MicroStrategy) holds the most bitcoins, with 640,808 BTC, valued at $73.24 billion. Followed by Strategy, MARA Holdings, Inc., Bitcoin holdings are 53,250, totaling $6.1 billion.

Overall, public companies currently hold 1,051,117 BTC, and private companies hold 279,185 BTC.

How Many Bitcoins Lost Forever?

It is estimated that 2.3 to 3.7 million Bitcoins are permanently lost. This represents 11-18% of the total supply. The Bitcoins sit in wallets where private keys have been lost, forgotten, or destroyed.

The common causes of losing bitcoins include hardware failures, forgotten passwords, discarded devices, and deaths without recovery information. Satoshi Nakamoto’s untouched 1 million BTC also contributes to this figure.

Lost coins effectively reduce the circulating supply, making remaining Bitcoins more scarce.

Source: Binance

What Happens When All Bitcoins Are Mined?

When the final Bitcoin is mined around 2140, miners will no longer receive block rewards. Instead, they will earn income solely from transaction fees paid by users.

This transition creates concerns about network security and miner incentives. However, if Bitcoin maintains sufficient value, transaction fees should provide adequate compensation to keep miners operational and secure the network.

Why Bitcoin’s Limited Supply Matters?

Bitcoin’s 21 million cap creates scarcity that drives value and protects against inflation in traditional currency systems.

- Scarcity Creates Value – Limited supply mirrors precious metals like gold, making Bitcoin a finite resource that cannot be arbitrarily increased.

- Inflation Protection – Unlike fiat currencies, which governments can print endlessly, Bitcoin’s capped supply prevents devaluation from oversupply.

- Predictable Monetary Policy – The issuance schedule allows investors to forecast future supply with complete certainty.

- Store of Value – Scarcity combined with durability and portability makes Bitcoin an effective long-term wealth preservation tool.

- Increased Demand Pressure – As adoption grows while supply remains fixed, basic economics suggests upward price pressure.

- Halvings Increase Scarcity – Regular reward reductions every 4 years progressively slow the rate of new Bitcoin creation.

- Lost Coins Increase Scarcity – Permanently inaccessible Bitcoins further reduce available supply, making remaining coins more valuable.

Conclusion: 21 Million Bitcoins Ever Exist

21 million Bitcoins is the highest limit. Approximately 19.94 million Bitcoins are already in circulation. Only 1.06 million remain to be mined by 2140. This scarcity makes Bitcoin valuable, similar to gold.

Major institutions and governments now hold Bitcoins. This shows that Bitcoin is still accepted as a serious asset. But remember, there are also the lost coins, totaling 3.7 million, which further reduce the available supply.

To start the Bitcoin journey, track live prices, market trends, and supply data to make the right investment decisions.

FAQs

The cap could technically be modified through network consensus, but such a change would require agreement from miners, developers, and users, making it extremely unlikely.

Lost Bitcoin estimates are approximations based on dormant wallet activity and blockchain analysis. The exact number remains unknown since lost coins look identical to held coins. However, it is estimated that 3.7 million Bitcoins have been lost until now.

After 2140, miners will earn income exclusively from transaction fees instead of block rewards, relying on network usage to maintain profitability and security.

Bitcoin supply will reach its maximum of 21 million around 2140. After that, no new Bitcoins will be created, but existing coins will remain tradable forever.

A miner’s time varies greatly depending on their equipment’s power and the level of competition. With average hardware, it could take years to mine one Bitcoin alone.

You can mine Bitcoin with proper equipment and electricity. However, individual mining is rarely profitable due to high costs and intense competition from large mining operations.